RECOMMENDATION FOR DEVELOPMENT OF ISLAMIC BANKING IN MALAYSIA

Since then numerous financial institutions have joined Malaysias Islamic finance market. As Malaysia is one of the.

What Is Islamic Finance And How Does It Work Global Finance Magazine

Value-based intermediation is the next direction for Islamic banking in Malaysia.

. The concept is that Islamic banking transactions should not just be Shariah compliant but also contribute positively and sustainably to the economy community and environment without compromising the financial returns to shareholders. I Well developed market Malaysia has placed strong emphasis on the development and expansion of Islamic finance including Islamic Banking takaful insurance Islamic capital market and Islamic money market for more than 30 years. In Malaysia the Islamic banking sector has contributed significantly to the development of the whole financial system which may in turn have an impact on economic growth Hassan et al 2011.

It also found that the Malaysian model in developing Islamic financial industry can be taken as a benchmark in the development of such industry in. Accordingly the Islamic banks licensed under IBA are required to include the provision for. However some areas need to be improved as suggested in the paper.

The assignment discussed about the development of Islamic banking in Malaysia as well as the recommendation to improve it. In due course Islamic banking and fi- nancial system were introduced to Malaysian economic agenda. With the establishment of IFSA 2013 the Islamic Banking Act 1983 the Takaful Act 1984 the payment System Act 2003 and the Exchange Control Act 1953 are repealed.

We can see Islamic banking can bring many advantages to peoples in Malaysia especially muslim who want to. Such recommendation then was included in Islamic Banking Act 1983 Act 276 hereinafter referred to as IBA passed by the Parliament of Malaysia in 1983. Throughout the years Islamic Banking and Finance in Malaysia has been undergoing numerous changes and.

A key recommendation under the FSB is for Malaysia to consolidate its success and position itself as a leading international centre and global hub for Islamic finance. Islamic finance is banking or financing activity that complies with sharia Islamic law and its practical application through the development of Islamic economicsSome of the modes of Islamic bankingfinance include Mudarabah Profit sharing and loss bearing Wadiah safekeeping Musharaka joint venture Murabahah cost plus and Ijara leasing. The issuance of new Islamic banking licences to qualified foreign financial institutions will allow for the presence of foreign Islamic banking players to act as a bridge between Malaysia and other global Islamic financial markets and increase the potential to tap new markets and growth opportunities.

As the Islamic banking system developed services offered by Islamic banks and banking institutions under Islamic Banking Scheme have become diversified Table 1. This paper employs a systematic literature review on best practice models and mechanism of current tawarruq structures as well as a proposed future. Brought forward to take place in 2004.

The growth and development of Islamic banking industry are supported through goods governance and its comprehensive legal frameworks. The Malaysia Hub since its establishment has partnered with Malaysian counterparts in cementing the countrys global leadership in Islamic finance. Nsc report on bank islam malaysia 9 an islamic bank which operates according to the rules of shariah should be established.

DEVELOPMENT OF THE ISLAMIC FINANCIAL SYSTEM IN MALAYSIA The tasks of NSC. Malaysia has a unique legislative framework consisting of mixed jurisdictions and mixed legal systems namely the common law and shariah. Only one islamic bank should be established.

The advent of Commercial banks about 200-250 years back made it difficult for Muslims to transact with non-compliant banks. Islamic banking services are very similar to those in conventional banks. 16 Pages Essays Projects Year Uploaded.

IFSA was a recommendation of the Financial Sector Blueprint 2011-2020 issued by Bank Negara Malaysia BNM. In terms of Islamic financial assets presently the total of Malaysia s Islamic financial. The inaugural issuance of the Worlds first green sukuk in Malaysia has expanded the narrative for the synergy between Islamic finance which values socially responsible investment and the global trends of.

The BIMB en- visaged a concrete milestone for the development of the Islamic banking and finance system in Malaysia. The paper found that Malaysia has a very encouraging history of Islamic banking and has big potential to succeed in this area. Islamic banking is really important to Islamic peoples in Malaysia in many ways.

Since the 1970s Malaysia has constructed a detailed plan to domestically develop Islamic finance into a full-fledged dual banking system by 2020ii The en-actment of the Islamic Banking Act of 1983 enabled the founding of the first Islamic Bank in Malaysia. The modus operandi of tawarruq in Islamic banking is an essential discussion as in jurisdictions like Malaysia most of the Islamic banks use tawarruq to structure the Islamic banking products. Assets stands at RM33 1863 billion as at Dec ember 2014.

ICD Thomson Reuters - Islamic Finance Development Report 2017. This research attempts to examine the influence of Islamic banking development on the growth of the Malaysian economy. Provide services and operating profitably.

Immediately after the establishment of IIUM Bank Is- lam Malaysia Berhad BIMB was established in July 1983. The proposed islamic bank should be incorporated as a limited company under the companies act 1965. These propositions promote the Malaysian Islamic capital market for the following reasons.

Malaysia has recorded 173 growth of Islamic finances market between 2009 -2014 MIFC 2015a. Islamic Property Financing Malaysia Ownership Syrah Introduction Obviously the establishment of Bank Islam Malaysia Berhad in 1983 had paved the way for the continuous development of Islamic Banking and Finance in Malaysia. It has tremendous potential to grow further in future.

- to study and identify various critical aspects of Islamic Banking. However some distinct differences can be. - to examine the suitability of Islamic Banking - to present recommendations regarding the establishment of Bank Islam Malaysia in a complete report.

Development of Islamic banking in Malaysia positively show a good sign which next maybe will be in same level as international banking institutions. 13 These figures shows how.

Islamic Banking History Timeline Download Scientific Diagram

1 Swot Matrix Awareness About Islamic Banking In Bih Download Table

Imf Survey Islamic Banks More Resilient To Crisis

Basic Rules Of Islamic Finance C Download Scientific Diagram

Pdf The Perception Of Islamic Banking By The First National Bank Sales Staff In The Kwazulu Natal Region Of South Africa Semantic Scholar

Imf Survey Islamic Banks More Resilient To Crisis

Imf Survey Islamic Banks More Resilient To Crisis

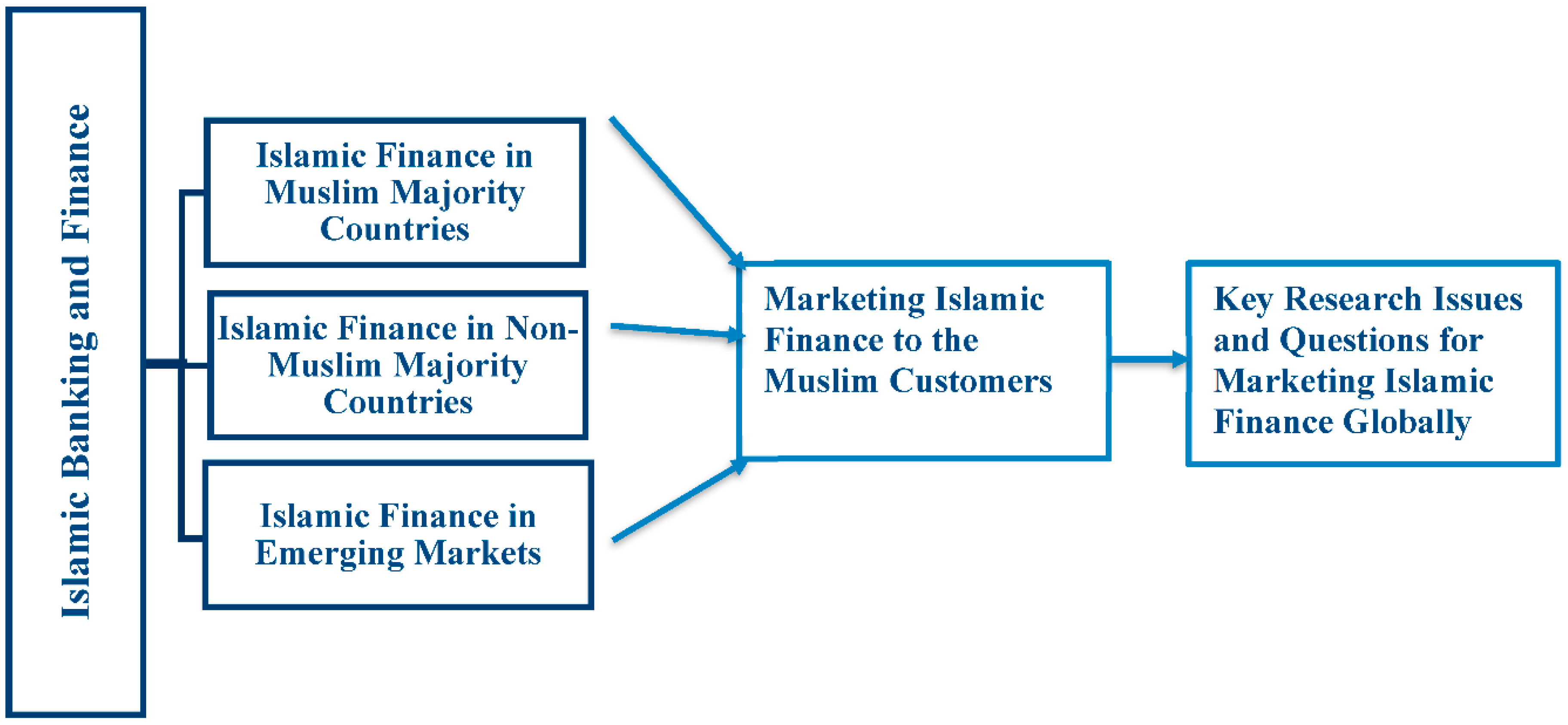

Jrfm Free Full Text Marketing Islamic Financial Services A Review Critique And Agenda For Future Research Html

Overview Of Different Types Of Conventional And Islamic Banks Download Scientific Diagram

0 Response to "RECOMMENDATION FOR DEVELOPMENT OF ISLAMIC BANKING IN MALAYSIA"

Post a Comment